According to the Monetary Authority of Singapore, more than 7.5 million credit cards (including supplementary cards linked to the principal cardholder's cards) were issued in Singapore in 2010. With market experts estimating eligible cardholders to be around 1 million, that would work out to each eligible cardholder owning 6 to 7 credit cards.

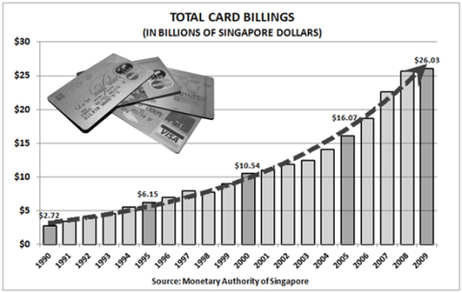

These statistics reflect the popularity of flashing plastic among Singaporeans. Such trends are certainly not exclusive to Singapore, but around the world as well. Let's examine more statistics. The chart below shows total credit card billings at S$26.03 billion in 2009. Should the trend continue as indicated, the latest estimated figure should be approaching S$30 billion!

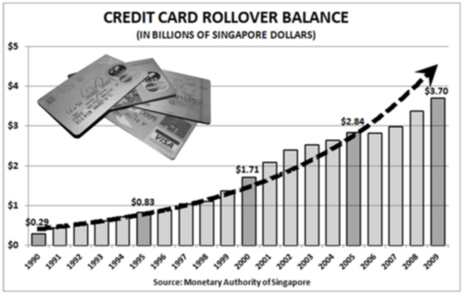

But are Singaporeans paying their credit card bills in full every month? Let's look at the data on the credit card rollover balance to find out. Credit card rollover balance refers to the balance that is subject to interest charges because it is not settled within the "free credit" period. This includes the minimum payment not settled by due date as well as the amount that is rolled over after settlement of the minimum sum. The credit cards rollover balance chart below tells us that Singaporeans have been piling up debts at a fast rate since 1990. The current estimate should be close to S$4.5 billion a year based on the trend line. Imagine the amount of interest they need to pay!

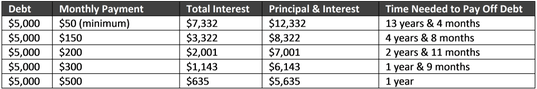

With most credit card companies in Singapore charging an exorbitant rate of 24% annually, it's not difficult to understand why credit cards are the worst form of debt. Let’s say you pay the minimum sum every month on the credit card debt owing to the bank that charges 24% per year. Assuming you have an outstanding amount of $5,000, the interest alone is a whopping $7,332 which is much more than the initial amount owing! Furthermore, the debt can only be fully paid in 13 years and 4 months (see table below).

Don't just pay the minimum sum every month but try to pay more to clear your debt much faster. How much faster should you increase the monthly payment amount? Let's compare.

If you pay $200 per month, you'll be able to clear your debt in about 3 years. Increasing your monthly payment to $500 a month will free you from debt a year later!

From the example given, a mere $5,000 debt will make you a slave to the bank for more than 13 years should you just pay a minimum sum every month. Try imagining owing a bigger amount! Are you already convinced that credit cards are the worst form of debt? I certainly hope so!

1 Comment

29/3/2013 10:12:18 am

Thanks for sharing such a nice info with us. Fantastic writing skills. Iappreciate this blog.

Reply

Your comment will be posted after it is approved.

Leave a Reply. |

|